The new European Union (EU) observing mission visit to Sri Lanka on the Generalized Scheme of Preferences (GSP) Plus exchange concessions plot has lighted much theory locally on the likely expenses of losing GSP to the EU.

Be that as it may, many such examinations have essentially under-assessed the likely misfortunes, frequently neglecting to represent crucial variables. Thus, in this article, the Joint Apparel Association Forum (JAAF) – the peak body addressing Sri Lanka’s attire area – looks to give partners a complete comprehension of the potential expenses of losing GSP to the EU.

In light of accessible proof, it is profoundly likely that this conveys substantial monetary just as ‘social and human expenses’ – the last especially from a destitution and weakness point of view.

EU: A crucial exchange accomplice

In the first place, putting the imperative significance of EU’s GSP in setting, commodities to the EU – Sri Lanka’s second-biggest objective for trades – represented almost a quarter (23 percent) of Sri Lanka’s total product profit in 2020. This is identical to generally 3.2 percent of Sri Lanka’s whole Gross Domestic Product (GDP) for 2020.

The EU represents an enormous part of the all-out products of a large number of Sri Lanka’s most important commodity businesses. Around 66% (61%) of the nation’s commodities to the EU advantage from GSP concessions. While somewhat the more significant part of these are attire – which represented 43% of the area’s income in 2020 – EU is likewise a critical market for Sri Lanka’s plastics and elastic item sends out, vegetable items, apparatus, and machines, food, drinks, and tobacco.

Businesses like fish, elastic items, and footwear make significantly more meaningful use of GSP than attire accomplishes (more than 90%, contrasted and under 50% for clothing) and henceforth, according to a nearby research organization, would likewise be profoundly helpless in case GSP is lost.

Opportunity costs are another thought. Accessible information predominantly shows that the GSP plot is gainful to nations that are qualified for these concessions. From 2011 to 2017, commodities to the EU by GSP recipients had expanded by 82per penny. In Sri Lanka’s case in explicit, a significant part of the development that empowered Sri Lanka’s clothing industry to send out the income of more than $5.3 billion preceding the pandemic in 2019 is credited to the EU. Note that Sri Lanka’s rivals, like Bangladesh, will keep on partaking in these advantages.

Extensive business sway

The ramifications of a GSP misfortune on neighborhood business are critical regardless of whether one was to consider just clothing and food item trades – the two of which advantage from the EU GSP conspire. The business has given consistent and continuous work to around 350,000 attire laborers while doing the job for 700,000 extra inside the country. As indicated by the 2019 version of the Annual Survey of Industries, more than 360,000 individuals are utilized in the food items area. Indeed, even after eliminating workers of non-send-out organizations in the food items area, this would infer that trade ventures that are vast recipients of EU’s GSP are also a portion of the country’s most influential businesses.

Besides, on account of attire, almost 80% of the representatives/partners are prevalently rustic ladies, suggesting that weak provincial gatherings remain excessively affected if GSP is lost. This would additionally intensify currently significant degrees of pay imbalance in the country. SMEs in the attire area could likewise be impacted undeniably, which also could add to the disparity.

Scholastic examinations done on the loss of GSP by Sri Lanka in 2010 (for instance, the review done by Bandara and Naranpanawa in 2014) have shown that destitution and pay imbalance probably expanded thus around then. A profoundly regarded Sri Lankan exchange master additionally expressed at a public discussion a few months prior that deficiency of GSP prompted around a 1 percent loss of GDP for the country.

Exchange shifts and then some

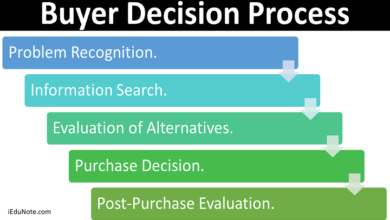

Past the above setting, consider the possible results of the deficiency of GSP to the EU to comprehend the full degree of the expenses in question. Two significant elements ought to be considered in such a manner; the probability of exchange shifts and the potential for negative falling impacts, for example, the deficiency of Sri Lanka’s other exchange concessions.

Attire brands and purchasers currently unequivocally favor start to finish arrangements suppliers. Subsequently, if Sri Lanka were to lose GSP to the EU – which would expand the expense of our clothing by 9.5 percent for purchasers in the EU – the deficiency of portion of the overall industry won’t be restricted to items that get GSP concessions. Purchasers could move as a group to Sri Lanka’s rivals, bringing about exchange shifts that would further impede our country’s interests.

Besides, there are giant equals between the conditions under which levy concessions are given to Sri Lanka by the EU’s GSP and other comparable plans that Sri Lanka now profits by. Thus, if Sri Lanka were to lose GSP to the EU, there is a high likelihood of exchange concessions to the UK and the even USA going under survey.

These business sectors are additionally indispensable business sectors for Sri Lanka’s commodities – with US and UK by and large representing more than 33% (34%) of Sri Lanka’s public products in 2020.

Likewise, the Sri Lankan attire industry desires to enter two different business sectors – Japan and Australia – additionally have GSP plans, demonstrated in the EU. Thus, the European Commission’s activities might influence those plans.

Likely loss of FDI

Unfamiliar Direct Investments (FDI) excessively would be adversely affected if GSP to the EU is lost.

Texture handling, which would reinforce the attire business’ regressive joining empowering more noteworthy usage of exchange concessions like GSP, is one of Sri Lanka’s key areas recently assigned for FDI. Nonetheless, if the nation is not qualified for exchange concessions, questions would emerge concerning the area’s feasibility. This would convey a critical chance expense for the country. Conceivably, a considerable number of work openings – both straightforwardly in texture handling and in the clothing area, which would extend, therefore – will be lost, along with a great many Dollars in strong FDI inflows.

Loss of foreign trade income from commodities, business, and FDI will have falling effects that prompt other unfortunate results. For example, foreign trade acquired from clothing and different products is fundamental for Sri Lanka’s essential imports – including food, medication, and fuel. Cash devaluation pressure and so on would likewise fuel.

GSP more significant than any other time

The above demonstrates that the expected loss of the EU’s GSP would antagonistically affect many fronts that could stream down to all areas of the economy. Product enterprises and the country’s economy, in general, have taken a heavy blow from the pandemic. The attire area also was essentially affected is as yet wrestling with numerous financial shocks. This incorporates request undoes and decreases, drop-in edges, giving more extended credit periods to purchasers, production network disturbances, and working with diminished staff in holding fast to security conventions.

Given these difficulties, the requirement for GSP is maybe more prominent than at any other time. In such a manner, we like the public authority exhibiting its unmistakable obligation to hold it. We are hopeful and confident that any worries can be resolved through helpful commitment.

In any case, this ought not to be interpreted as a sign of the business depending on GSP concessions endlessly in the medium to the long haul. We have set up purposeful drives to improve the area’s seriousness. This incorporates creating key (rather than value-based) associations with purchasers, updating innovative work abilities and expanding advancement, creating marked items, and endeavors to differentiate send out business sectors. These are not simple cases by the area and have been perceived by purchasers and surprisingly in distributions of the World Bank.

Holding our current particular exchange concessions along with the drives in progress to improve the business’ intensity will empower Sri Lanka’s clothing industry to accomplish its objective of turning into an $8 billion commodity worker by 2026. This will essentially expand our commitment to the homegrown economy as far as commodity profit, work, innovation mixture, and venture. The business is entirely dedicated to this assignment however requires adequate solidness, particularly insurance from additional financial shocks, to accomplish this objective.