In an era where convenience and accessibility reign supreme, the financial world is undergoing a quiet revolution. With its brick-and-mortar branches and physical cards, traditional banking is giving way to the digital age. It’s a shift that promises to transform how we manage our finances and make payments. Welcome to the world of instant virtual debit cards online and virtual Visa Mastercards, where your wallet exists in the cloud and transactions happen at the speed of a click.

The Evolution of Payment Methods

Before we dive into the exciting world of instant virtual debit cards and virtual Visa Mastercards, let’s take a moment to reflect on how far we’ve come. The history of payments is a fascinating journey that has brought us from bartering coins to plastic cards and virtual wallets.

From Bartering to Virtual Cards

Picture this: you’re a merchant in ancient Mesopotamia, trading goods with your neighbour. The exchange is simple and direct—bartering. You offer a grain sack in exchange for a fine piece of pottery. This age-old method of trade laid the foundation for modern commerce.

Fast forward to the 20th century, and we witness plastic cards’ birth, forever altering how we interact with money. The introduction of credit and debit cards made transactions more convenient than ever. However, the cards themselves were physical, and one had to carry them, leading to concerns about theft and loss.

Enter the 21st century, where the digital revolution has transformed nearly every aspect of our lives. The financial industry has embraced this digital wave, giving rise to instant virtual debit cards online and virtual Visa Mastercards. But what exactly are these digital wonders, and how are they changing how we manage our finances?

The Advent of Instant Virtual Debit Cards Online

Instant virtual debit cards online have taken the banking world by storm. Imagine having a debit card that exists solely in the digital kingdom without a physical plastic card. Sounds futuristic, doesn’t it? But it’s very much a reality today.

Seamless Banking in the Cloud

With instant virtual debit cards online, your banking experience occurs in the cloud. Your virtual card is securely stored on your mobile device or computer, accessible with a few taps or clicks. This convenience eliminates the need for physical cards, making your wallet slimmer and your life simpler.

Key Features of Instant Virtual Debit Cards Online

Instant Issuance: Traditional banks may take days to issue a physical card, but with virtual debit cards, you can have one within minutes. Need to make a purchase urgently? No problem.

Enhanced Security: Forget about the risks of losing or stealing your card. Virtual cards are protected by robust encryption and authentication measures, making them highly secure.

Global Accessibility: Your virtual debit card isn’t bound by geographical limitations. You can use it for online purchases worldwide hassle-free.

Budget-Friendly: Many virtual card providers offer budgeting tools that help you track your spending and stay on top of your financial goals.

Contactless Payments: With the rise of NFC technology, making contactless payments with your virtual debit card is a breeze.

You might wonder, “What about a physical card for in-store purchases?” Well, that’s where virtual Visa Mastercards come into play.

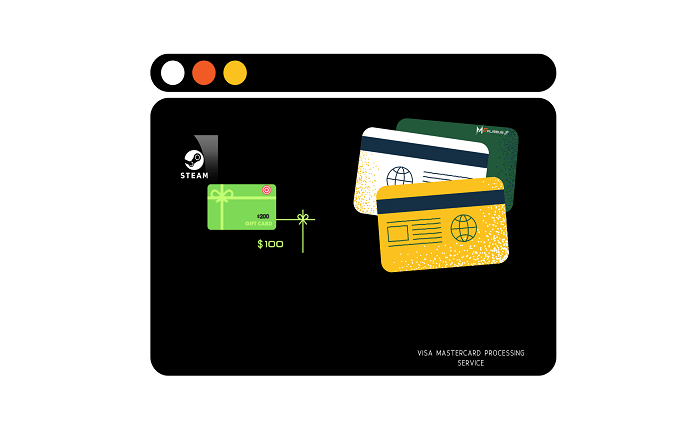

The Power of Virtual Visa Mastercard

Virtual Visa Mastercards are a game-changer for those who still want the option of physical payments while enjoying the benefits of the digital age. Tied to your virtual wallet, these cards offer the best of both worlds.

The Hybrid Approach

Virtual Visa Mastercards bridge the gap between the physical and digital realms. They are generated electronically and can be used for both online and in-store purchases. Here’s why they’re gaining popularity:

- Flexibility: Virtual Visa Mastercards can be linked to various funding sources, giving you flexibility in managing your finances.

- Security: Just like instant virtual debit cards online, virtual Visa Mastercards offer enhanced security features, reducing the risk of fraud and unauthorized transactions.

- Instant Gratification: Need a card for that impromptu shopping spree or dinner date? Virtual Visa Mastercards can be generated on-demand, providing instant gratification.

- Eco-Friendly: Virtual Visa Mastercards contribute to a more sustainable and eco-friendly future by reducing the need for physical cards.

The Rise of Mobile Wallets

As we delve deeper into the world of instant virtual debit cards and virtual Visa Mastercards, it’s essential to mention the role of mobile wallets in this financial transformation. Mobile wallets, such as Apple Pay, Google Pay, and Samsung Pay, have become the conduits for these virtual cards.

Seamless Integration

Mobile wallets seamlessly integrate instant virtual debit cards online and virtual Visa Mastercards, allowing users to make secure, contactless payments with their smartphones or smartwatches. The convenience of simply tapping your device to complete a transaction has changed how we perceive costs.

Advantages of Mobile Wallets

One-Stop Shop: Your mobile wallet is a hub for all your payment methods, from credit and debit cards to loyalty cards and boarding passes.

Enhanced Security: Mobile wallets use biometric authentication methods, such as fingerprint or facial recognition, to ensure that only you can access your virtual cards.

Digital Receipts: Say goodbye to paper receipts. Mobile wallets provide digital receipts for your transactions, making expense tracking a breeze.

Travel-Friendly: Mobile wallets are widely accepted worldwide, making them the ideal travel companion.

A Personal Perspective

To truly understand the impact of instant virtual debit cards online and virtual Visa Mastercards, let’s consider a personal experience. Meet Sarah, a young professional navigating the hustle and bustle of city life.

Sarah recalls the days when she used to carry a bulky wallet filled with cards, cash, and receipts. Finding the right card for each transaction was a constant struggle, and she often worried about losing her purse. One day, Sarah embraced the digital age and explored the world of instant virtual debit cards online.

The transition was seamless. She signed up for a virtual banking account, received her instant virtual debit card within minutes, and added it to her mobile wallet. Sarah was amazed at how easy it was to make payments. Whether splitting a restaurant bill with friends or purchasing her morning coffee, her virtual card was up to the task.

Sarah’s next step was to try out a virtual Visa Mastercard for in-store shopping. She generated one on her mobile app before heading to a department store. The cashier scanned the virtual card’s barcode on her smartphone screen, completing the transaction. Sarah left the store with her purchases, knowing that her virtual Visa Mastercard offered the security she needed.

Now, Sarah can’t imagine going back to the days of physical cards and a cluttered wallet. The convenience, security, and simplicity of instant virtual debit cards and virtual Visa Mastercards have transformed her financial life.

Challenges and Considerations

While instant virtual debit cards online and virtual Visa Mastercards offer many benefits, it’s essential to acknowledge the challenges and considerations associated with this digital shift.

Online Dependency: Relying on virtual cards and mobile wallets means connecting to the internet. In areas with poor connectivity, this can pose challenges.

Security Concerns: Although virtual cards are highly secure, cyber threats constantly evolve. Staying vigilant and practising good cybersecurity hygiene is crucial.

Technological Barriers: Not everyone has access to a smartphone or the technical know-how to manage virtual cards effectively. Ensuring inclusivity is a crucial consideration.

Final Verdict

The rise of instant virtual debit cards online and virtual Visa Mastercards indicates a broader trend in the financial industry—the transition to a digital-first approach. These innovations offer the convenience, security, and flexibility that were once unimaginable.

As we look to the future, it’s clear that traditional banking is evolving. How we handle money is changing, and our wallets are becoming lighter, physically and metaphorically. The convenience of instant virtual debit cards and the versatility of virtual Visa Mastercards, combined with the power of mobile wallets, are shaping a new era of finance.

So, the next time you reach for your wallet, ask yourself: Is it time to embrace the future of banking? With instant virtual debit cards online and virtual Visa Mastercards, the answer is a click away.

In a world where change is the only constant, these digital innovations are leading the way, offering us a glimpse into the exciting possibilities.