Latest News

-

-

-

-

-

-

March 10, 2024

March 10, 2024Employer of Record UAE

-

February 22, 2024

February 22, 20245 Ways to Increase Your Brand’s Visibility in 2024

-

February 20, 2024

February 20, 2024Why Rich People Drive Cheap Cars

-

-

February 14, 2024

February 14, 2024Top Reasons Why You Should Learn Selenium WebDriver

-

February 13, 2024

February 13, 2024Beyond the Numbers: The Human Element in Property Valuation

-

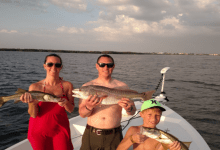

February 1, 2024

February 1, 2024Inshore Fishing: A Vacationer’s Guide to Coastal Thrills

-

February 1, 2024

February 1, 2024From Gold to Silver: Examining Adelaide’s Bullion Options